If you’ve opened a market app lately and felt your blood pressure spike, you’re not alone. Over the past several months—and especially this week—U.S. markets have been getting rocked by a familiar cocktail: big-tech volatility, shifting expectations around AI profitability, and renewed uncertainty about inflation and rates.

Today’s selloff is a good example of how fast “confidence” can evaporate in paper markets. Reuters reported broad declines tied to renewed tech weakness, with investors reacting to large AI spending plans and softer outlooks from major tech names.

In moments like this, buyers and landowners start asking the same question: how are land values holding up compared to stocks and other assets right now?

The short answer: land tends to move slower, break slower, and recover more steadily—because its value is rooted in utility and scarcity, not daily sentiment.

This article breaks down:

-

what’s been driving market turbulence into early 2026,

-

what the latest land-value data says nationally and in Michigan,

-

why Michigan recreational and rural property often behaves like a “stability asset,”

-

and how to evaluate land like an investor (not a tourist).

What’s driving the turbulence in early 2026

Markets don’t sell off “for one reason.” They sell off because multiple pressures stack up—then the selling feeds itself.

Markets don’t sell off “for one reason.” They sell off because multiple pressures stack up—then the selling feeds itself.

1) Tech and the AI trade: huge spending, delayed payoff fears

One of the major catalysts in the current wave of volatility is the tech sector itself. Reuters noted that investor anxiety has been fueled by concerns over the scale of AI-driven capital spending and what it could mean for near-term margins and returns, alongside weaker guidance from key firms.

Investopedia also highlighted Alphabet’s disclosed 2026 capex range (and broader investor concern around AI spending).

When the market’s leadership is concentrated, a wobble in the leaders becomes a wobble in everything.

2) Inflation progress has stalled, keeping rates “sticky”

The other recurring driver is inflation uncertainty. Federal Reserve Governor Lisa Cook said inflation progress has “stalled,” pointing to December 2025 readings around 2.9% year-over-year PCE and about 3% core PCE, reinforcing why the Fed remains cautious.

Separately, Reuters reported the Fed held rates steady in late January 2026 and described inflation as “somewhat elevated.”

Translation: investors can’t confidently price the next phase of the rate cycle, and uncertainty is gasoline for volatility.

3) Labor-market signals are flashing more yellow than green

Risk appetite also takes a hit when job and hiring signals weaken. Reuters reported that planned layoffs surged in January 2026 (Challenger, Gray & Christmas), with the January total described as the highest for that month since 2009, and hiring intentions notably weak.

When the market sees layoffs + cautious guidance + sticky inflation, it tends to “de-risk” fast.

Why land behaves differently than paper assets

The biggest difference between land and most paper assets is simple:

The biggest difference between land and most paper assets is simple:

Land isn’t repriced every second by global sentiment.

That “boring” quality is a feature, not a bug.

Land is not mark-to-market daily

Stocks and crypto can drop 3–10% in a session based on a headline, a conference call tone, or a change in risk appetite.

Land doesn’t work like that. Land markets are slower because they’re driven by:

-

local supply/demand,

-

financing conditions,

-

comparable sales,

-

and utility value.

So while paper markets can panic-sell, land tends to reprice in measured steps.

Land has utility value, not just “trade value”

Michigan land has real, durable use cases:

-

hunting and recreation,

-

timber potential,

-

agricultural use/leases in many areas,

-

long-term legacy ownership,

-

and in some corridors, future development pressure.

Even when investors are nervous, people still want access, privacy, and a place that does something.

Land’s scarcity is physical and geographic

You can create more shares. You can create more coins.

You can’t create more waterfront, more “right county,” more “perfect access with habitat and timber transition.” Quality tracts are finite.

The latest data: Land values have held up—Michigan especially

Let’s put real numbers behind the “land is stable” claim.

Let’s put real numbers behind the “land is stable” claim.

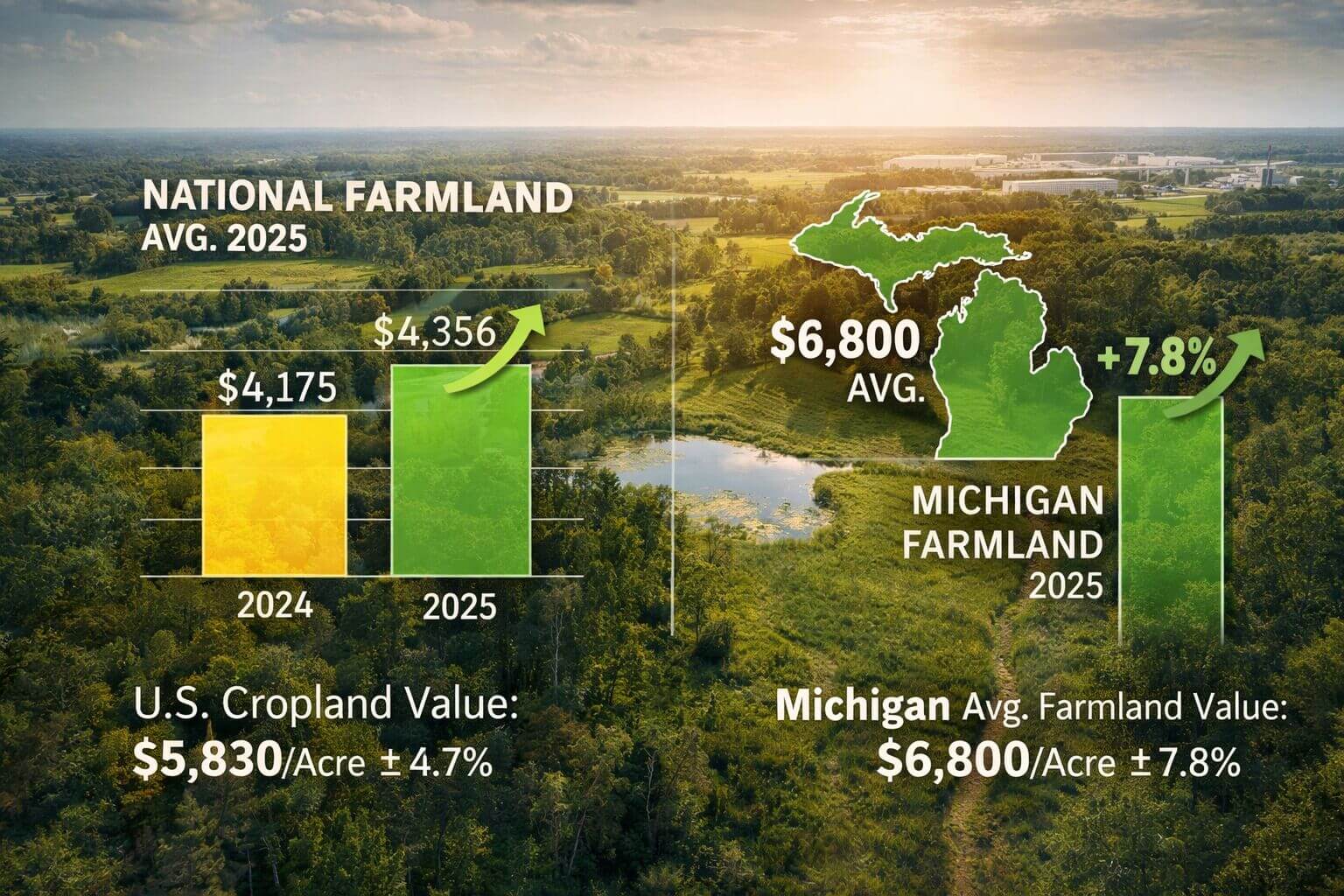

National farmland: still rising in the latest USDA numbers

USDA’s National Agricultural Statistics Service reported that U.S. farm real estate value averaged $4,350 per acre for 2025, up 4.3% from 2024.

That same NASS report shows U.S. cropland averaged $5,830 per acre in 2025, up 4.7% year over year.

USDA’s Economic Research Service (ERS) added useful context: inflation-adjusted U.S. average cropland values rose 2.2% (2024→2025) to $5,830 per acre, emphasizing that land values have been resilient even after adjusting for inflation.

That’s not “bubble math.” That’s broad-based persistence.

Michigan: outperforming national growth in reported averages

Bridge Michigan reported that Michigan farmland values increased about 7.8% year over year, with an average around $6,800 per acre, and noted development conversion pressure as a contributor in some areas.

MWP’s own market commentary heading into 2026 cites the same late-2025 reporting figures and frames the “development pressure” dynamic clearly.

Key takeaway: Michigan is not just “tracking the national line.” In certain zones, it’s been stronger.

Institutional real-asset context: timberland shows steadier, lower-drama behavior

For readers who want a “capital markets” lens: NCREIF’s institutional indices show timberland with a positive total return of 1.59% in 4Q 2025, while farmland showed a negative total return of -0.70% in that quarter (with income positive but appreciation negative).

This matters because it reinforces a core truth: land-based assets often behave differently than equities—and even within “land,” sub-sectors (timber vs farmland) can diverge depending on commodity cycles, income, and appraisal timing.

Why Michigan recreational and hunting land can stay resilient in volatility

Michigan recreational property isn’t priced like a tech stock. It’s priced like a scarce, usable asset with lifestyle demand baked in.

Michigan recreational property isn’t priced like a tech stock. It’s priced like a scarce, usable asset with lifestyle demand baked in.

1) Buyers aren’t purely financial—they’re lifestyle + legacy

A major portion of recreational land demand is driven by:

-

family traditions,

-

hunting access,

-

“weekend utility,”

-

and long-term lifestyle decisions.

That buyer psychology is different than “sell it if it’s down 7%.”

2) Michigan has fundamentals that quietly support land values

Even without getting overly “salesy,” Michigan checks a lot of stability boxes:

-

huge cultural demand for outdoor recreation,

-

diversified habitat types and timber influence in many regions,

-

thousands of lakes and river corridors,

-

and proximity-to-metros dynamics in select areas.

When volatility hits paper markets, people don’t stop wanting a place to hunt, fish, camp, and bring their kids.

3) Recreational land has “multi-engine value”

The strongest Michigan tracts often have more than one value driver:

Engine A: Recreation

-

habitat diversity,

-

food plot potential,

-

trail systems,

-

water features,

-

huntability and access.

Engine B: Productivity

-

timber value and management potential,

-

limited ag lease potential in some zones,

-

potential income offsets over time.

Engine C: Optionality

-

future improvements,

-

the ability to broaden buyer pool (camp/build potential where allowed),

-

adjacency to growth corridors (in specific markets).

The more engines a property has, the less dependent it is on a single market narrative.

The honest part: Land isn’t a magic shield

If anyone tells you land “never goes down,” they’re selling you something.

Land can soften—especially when:

-

interest rates rise and financing tightens,

-

buyer pools thin,

-

or when pricing got ahead of fundamentals.

But land tends to soften differently than paper assets:

-

fewer panic sellers,

-

slower repricing,

-

and a bigger quality gap (great land holds, marginal land gets exposed).

That’s why “what kind of land” matters more than “land in general.”

How to evaluate Michigan land like an investor

If you want land to behave like a stability asset, you have to buy it like one.

If you want land to behave like a stability asset, you have to buy it like one.

Non-negotiables (stuff that protects value)

-

Legal access clarity

-

Verify deeded access, easements, and road maintenance realities.

-

Boundaries and title hygiene

-

Survey clarity (or a plan to get one),

-

boundary markers,

-

no fuzzy “it’s somewhere over there” lines.

-

Water reality

-

Water adds value.

-

But so do properly understood wetlands, crossings, and seasonal access.

-

Roads and trail systems

-

A tract that’s easy to show, tour, and use is easier to sell later.

Value multipliers (what separates “good” from “great”)

-

Timber structure and age classes (and whether it’s been managed well)

-

Habitat diversity (edges, transitions, cover, food)

-

Build/camp potential (where allowed)

-

Proximity to towns (yes, even for hunting ground—because resale buyers are humans)

Volatility-proofing your purchase

If we had to distill it to a simple strategy:

-

Pay for access and fundamentals.

-

Avoid gimmicks.

-

Keep optionality.

-

Don’t buy “land with problems you’re not prepared to own.”

That’s how you avoid becoming the person who lists a tract during a shaky market with a pile of unresolved issues.

Where land fits in a portfolio when markets are chaotic

This is not financial advice—just reality.

This is not financial advice—just reality.

Land tends to work best as:

-

a stability sleeve (slow-moving, real-asset exposure),

-

a utility asset (you can use it even if markets are ugly),

-

and a long-duration hold (measured returns, lower drama).

In contrast, high-beta assets (growth tech, speculative names, some crypto) behave like emotional teenagers when volatility hits. Today’s market reaction is a case study.

If you want something you’re less likely to rage-sell, land is a strong candidate—provided you buy quality and manage expectations.

What we’re watching in 2026 for Michigan land

A few forces will likely shape land pricing and demand this year:

- Rate and financing conditions

- A tighter lending environment narrows the buyer pool.

- Cash buyers gain relative strength.

-

Development pressure in select areas

- Michigan’s reported farmland value growth has been linked partly to development conversion pressure in some zones.

-

Supply of quality tracts

- Good access + good habitat + clean paperwork doesn’t suddenly become abundant.

- Scarcity supports pricing even when the broader mood is uncertain.

-

Macro volatility staying “sticky”

- Inflation uncertainty remains a key market driver into 2026 per Fed commentary and recent reporting.

FAQ: Land as an asset in volatile markets

Does land go down in recessions?

It can soften, especially marginal tracts or over-priced listings. But the adjustment is typically slower and more location/quality dependent than daily-traded assets.

Is recreational land a hedge against inflation?

It’s a real asset with scarcity and utility, which often helps in inflationary regimes. USDA’s recent value data shows continued resilience in farmland values through 2025.

What’s the difference between farmland, timberland, and hunting land as investments?

They have different return drivers. NCREIF’s institutional indices show that even within “land,” farmland and timberland can diverge by quarter based on income and appraisal-driven appreciation.

How do interest rates affect land prices?

Higher rates can reduce financed demand and slow transaction volume, especially on larger purchases. But land markets don’t “gap down” the way equities can—pricing tends to adjust through time, comps, and deal structure.

What makes Michigan land uniquely resilient?

Michigan combines strong outdoor recreation demand, diverse property types, and in some regions, added development pressure that can influence pricing.

Closing: The stability advantage of “quiet assets”

When markets are in turmoil, people don’t suddenly stop valuing:

-

access,

-

privacy,

-

family experiences,

-

and scarce, usable property.

That’s why land—especially quality recreational land—often behaves like a quiet stabilizer while paper assets swing.

If you’re considering buying or selling Michigan land in 2026, the smartest move is to treat it like the asset it is:

-

understand the fundamentals,

-

price it with reality,

-

and focus on the things that hold value when markets get noisy.