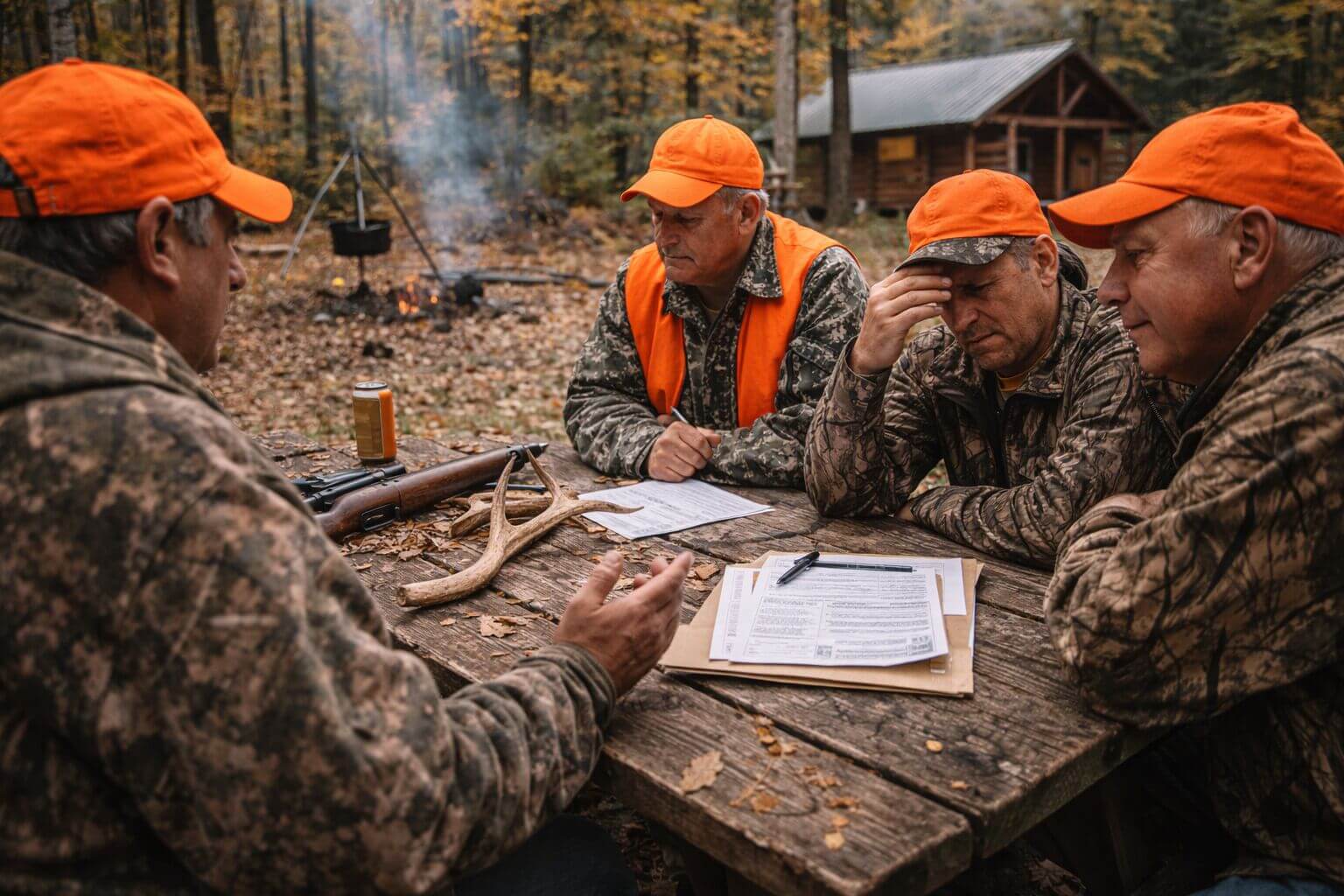

Most Michigan hunting land conversations start the same way.

You’re leaning on the tailgate. Coffee’s hot. Wind’s wrong. And somebody eventually says, “Man, these taxes are getting stupid.”

That’s usually when the Qualified Forest Program (QFP) comes up.

We talk about QFP with hunters all the time because—when the property fits—it just makes sense. It’s one of those rare programs where the state’s goals and a hunter’s goals actually overlap. You manage the woods responsibly. The state rewards you with lower property taxes. Everybody wins.

But here’s the problem: QFP gets misunderstood more than almost any land program we deal with. Half-truths get passed around deer camp. Deadlines get missed. And some folks assume it’s way more complicated than it really is.

Let’s clear the air.

What the Qualified Forest Program Really Is (In Plain Michigan English)

At its core, QFP is a Michigan property tax incentive overseen by the Michigan Department of Agriculture and Rural Development (MDARD).

At its core, QFP is a Michigan property tax incentive overseen by the Michigan Department of Agriculture and Rural Development (MDARD).

The deal is simple:

If you own forestland and agree to actively manage it under a professional forest management plan, Michigan reduces part of your property tax burden.

That’s it.

No public access requirement.

No forced clear-cuts.

No turning your hunting property into a timber factory.

For a lot of hunters, QFP fits like a glove—especially those who own 20 acres or more of mostly woods and plan to keep it for the long haul.

Why QFP and Hunting Land Line Up So Well

Most hunting properties already check the right boxes:

Most hunting properties already check the right boxes:

-

They’re heavily wooded

-

They’re owned long-term

-

They’re lightly developed (if at all)

-

The owners care about habitat—even if they don’t call it “forest management”

When a forester talks about improving stand health, creating age diversity, or opening up the canopy, hunters hear something else:

More browse. Better cover. Improved movement.

When QFP is done correctly, timber work and hunting goals don’t fight each other—they complement each other.

Eligibility: Where the Rubber Meets the Road

This is where the myths start to fall apart.

This is where the myths start to fall apart.

Acreage and Stocking Requirements

To qualify for QFP in Michigan, your property must:

-

Contain at least 20 contiguous acres per tax parcel

-

Be classified as productive forestland

Stocking requirements depend on acreage:

-

20–39.9 acres: at least 80% stocked with productive forest

-

40+ acres: at least 50% stocked

Here’s the part that catches people:

Open fields, food plots, brushy low ground, and wetlands don’t always count as productive forest.

A few food plots and trails? Usually fine.

Half the property in grass or scrub? That’s where problems start.

The Forest Management Plan (Yes, You Need One)

QFP is not a “fill out a form and forget it” program.

You must have a Forest Management Plan written by a Qualified Forester recognized by MDARD. That plan outlines:

-

Tree species and forest stands

-

Management goals

-

Timber harvest schedule

-

Regeneration and improvement work

We’ll say this clearly, because it matters:

A good forester who understands hunting land makes all the difference.

The wrong forester writes plans for board feet.

The right forester writes plans that still let you kill big deer.

Cabins, Pole Barns, and Camps: Allowed—but Misunderstood

Yes, you can have buildings on QFP land.

Yes, you can have buildings on QFP land.

Cabins.

Pole barns.

Storage sheds.

But QFP only applies to land value, not structures.

That means:

-

The land portion may be exempt from school operating tax

-

Buildings are still taxed normally

This doesn’t sink the program. It just means expectations need to be realistic.

How the Tax Savings Actually Works (Real Talk)

Let’s strip away the accounting language.

Let’s strip away the accounting language.

The Main Benefit: School Operating Tax Exemption

QFP primarily exempts qualified forestland from local school operating taxes, often up to 18 mills, depending on the district.

Here’s a simple example.

Land Only:

-

40 acres

-

$60,000 taxable value on land

-

18 mills exempted

That’s roughly $1,080 per year back in your pocket.

Every year.

No gimmicks.

What Happens When There’s a Cabin?

Let’s say the same property also has a cabin with:

-

$120,000 taxable value

That portion still pays school operating tax.

QFP doesn’t erase your tax bill—it trims the biggest line item on most hunting properties: the dirt itself.

Buying Land Already in QFP? Pay Attention.

If you buy property already enrolled, you may qualify for a Qualified Forest Taxable Value Affidavit (QFTVA).

When handled correctly, it can:

-

Prevent taxable value from uncapping

-

Keep taxes closer to the seller’s level

Miss this paperwork, and you can accidentally undo years of smart planning.

We dive deeper into this exact issue here:

👉 Hidden Property Tax Traps When Buying Michigan Hunting Land

Deadlines That Matter (And Why Hunters Miss Them)

Michigan doesn’t care how busy fall gets.

Michigan doesn’t care how busy fall gets.

September 1: Application Deadline

To receive QFP benefits for the next tax year, MDARD must receive a complete application package by September 1.

Not started.

Not postmarked.

Complete.

Miss it, and you’re waiting another year.

December 31: Affidavit Deadline

Approval alone doesn’t trigger the savings.

You must:

-

Sign and notarize the affidavit

-

Record it with the county

-

Deliver it to your local taxing authority

All by December 31.

This step gets forgotten more than we like to admit.

A Timeline That Actually Works

Here’s what we recommend:

-

Winter–Spring: Talk to a forester

-

Spring: Management plan drafted

-

Summer: Application assembled

-

September 1: Submitted to MDARD

-

Fall: Approval received

-

By December 31: Affidavit recorded and delivered

Simple. Boring. Effective.

Common QFP Mistakes We See at Deer Camp

We see the same issues over and over.

We see the same issues over and over.

-

Assuming “woods = qualified”

-

Waiting too long to hire a forester

-

Forgetting the December 31 affidavit

-

Thinking buildings are exempt

-

Ignoring harvest schedules

-

Changing land use without rescission

Any one of these can delay—or derail—the benefit.

If you’re planning to build, this article pairs well:

👉 Buying Recreational Land in Michigan: What You Need to Know Before You Build

Selling, Building, or Leaving the Program

Life changes. Land changes.

Life changes. Land changes.

-

Selling? Coordinate QFTVA paperwork.

-

Building? Keep forest stocking intact.

-

Leaving QFP? Formal rescission is required—and penalties can apply.

This is where having the right guidance matters most.

QFP vs. Commercial Forest Program (Quick Gut Check)

| Feature | QFP | Commercial Forest |

|---|---|---|

| Public access required | No | Yes |

| Typical acreage | 20–160 acres | Large tracts |

| Fit for hunters | Excellent | Limited |

| Tax approach | School tax exemption | Flat per-acre rate |

Most private hunting land fits QFP far better.

Is QFP Right for Your Michigan Hunting Property?

QFP isn’t magic. It’s not for every parcel.

But if you own 20+ wooded acres, plan to hold it long-term, and are open to professional forest management, it’s one of the smartest tools available to Michigan hunters.

We help buyers and sellers evaluate QFP before mistakes get baked into the deal—and before tax bills get locked in.

👉 Explore available properties here:

Michigan Hunting Land for Sale

If you want to talk through whether QFP fits your land—or a property you’re considering—we’re happy to help. Just like at deer camp, sometimes it only takes one honest conversation to save a whole lot of frustration.